Introduction

Two user-friendly services with U.S. bases, Coinbase and Robinhood, enable newcomers to purchase and trade cryptocurrency. Leading cryptocurrency exchange Coinbase and cutting-edge trading app Robinhood are two of the most well-liked locations for American investors to acquire and sell cryptocurrencies. Both offer user-friendly interfaces and are incredibly well-liked trading and investing services. But which one fits you the best?

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam. It is the 2nd largest centralized exchange in the United States by volume, supporting the world’s most popular cryptocurrencies. A new investor can get started quickly with the help of an intuitive app and the ability to buy crypto with a credit card.

Baiju Bhatt and Vladimir Tenev founded Robinhood in 2013 to offer everyday retail investors access to low-fee trading. The app is recognized for its simple design and ability to help novice traders start trading. They announced the possibility of purchasing Bitcoin in 2018 and have since added a few more popular cryptocurrencies to their platform.

What is a Crypto App?

A cryptocurrency app provides users with a place to buy, sell, and trade cryptocurrency. It functions as a market where prices are updated in real-time, so you can deposit money and conduct transactions using the cryptocurrency of your choice.

What is a Crypto App used for?

Users of cryptocurrency apps can deposit fiat fast and with minimal fees, trade cryptocurrency for free or at a low cost, and withdraw their cryptocurrency for free or with minimal costs. Users can also invest in various ways, like mining, staking, and having integrated custody for institutions, on the best cryptocurrency apps and exchanges.

To make more profitable trades, good apps also let traders track prices in real-time, set real-time alerts, and perform complex charting.

What to consider when choosing a Crypto App?

As cryptocurrency grows in popularity and becomes more widely used, more people will be unsure of which app they should use to purchase and sell these digital assets. There are dozens of features to inspect across exchanges, and users have varying degrees of cryptocurrency and investment knowledge. Regardless of whether or not you have experience choosing a cryptocurrency app, here are some things to consider:

– Security and Authenticity

It is crucial to conduct research and make sure you select a reliable and safe platform. The current attack of Coincheck and the early example of Mt. Gox serves as grave cautions to potential cryptocurrency investors to investigate the app’s security mechanism.

Pump-and-dump tactics are currently one of the main problems facing the bitcoin sector. Exchanges are in charge of stopping this fraud. They receive assistance from tokens there. To prevent this scam, it is the exchanges’ responsibility to use tokens.

– Supported Tokens

Most applications support Bitcoin and Ethereum, but cryptocurrency investors know that is just the tip of the iceberg. There is a vast array of cryptocurrencies that are supported by different apps, with some trading a long list of altcoins, while others only accept a few major coins. You can offset your risk by choosing “stable coins” — coins that traders often use to hedge against the volatility of cryptocurrency markets.

TrueUSD, for example, is a USD-backed cryptocurrency that is directly secured by a network of banks. It uses custodial accounts to provide legal protection and direct banking to token holders, so the company never makes contact with the funds.

Custodial accounts also facilitate regular auditing and complete legal protection. TrueUSD is a common, stable currency across digital exchanges because it is backed by the US Dollar. A new alternative is urgently needed after Tether, the incumbent USD stable coin, was subpoenaed by the SEC.

Whatever your level of risk tolerance, be careful to pick an exchange or exchanges that accept all of the cryptocurrency tokens you want to buy. These exchange rates are influenced by metrics, such as 24-hour volume and market cap, which should be tracked.

– Purchase Method

Buying cryptocurrency differs amongst apps in terms of how it is done. Some Crypto apps only allow cryptocurrency purchases, while some others accept cards, PayPal, bank transfers, and direct bank deposits.

Selecting a platform that accepts fiat money is crucial if you lack cryptocurrency before joining an exchange to enter the market. It’s also critical to consider how long it takes to finish a purchase. While some platforms may take days or weeks, some platforms process transactions almost quickly.

– Broker, P2P Exchange, or Trading Platform

There are three major types of cryptocurrency exchanges, so before selecting one, you need to know what they are. Robinhood and Coinbase are two of the most common trading platforms. They are cryptocurrency apps, in which users place to buy or sell orders for cryptocurrency and interact with the platform only by themselves.

In addition, there is a transaction fee. P2P exchanges, such as Cointal, connect buyers and sellers to interact directly, relying on both parties to agree to any transaction. P2P exchanges work to lower network congestion and provide a trusted and secure platform for the trading of cryptocurrencies.

Cointal is the first multi-currency P2P exchange. Mohammed Imad, the CEO of Cointal, says, “Dealing on a P2P basis helps alleviate the risks and problems that can arise from traditional exchanges.” Cryptocurrency brokers like AvaTrade are similar to forex brokers in that they set prices and buyers can use the platform to buy cryptocurrencies.

– User Interface and Experience

For the average cryptocurrency investor, user interface and functionalities are the most important aspects. Whether you are a seasoned crypto trader or you are buying bitcoin for the first time, an intuitive interface and a satisfying user experience make user actions on the app more knowledgeable and more efficient.

Different people will appreciate different interfaces, and user experience is subjective, but in the future, the exchanges that provide the “best” user experience will see the most growth in transaction volume.

Since an exchange’s value is largely linked to its user number, exchanges can leverage their user experience to increase their user numbers and transactions. Some apps have proven this ability by offering users free tokens in exchange for using their exchange.

– Fee Schedule

It’s important to note that different apps have different transaction fees and fee structures. Some exchangers provide reduced fees. When an app’s token is used to finalize transactions, this happens. It may also be hand-in-hand with the number of tokens possessed. Others just levied a processing fee on sales, allowing fee-free purchases.

Coinbase

Image Credit: finder.com

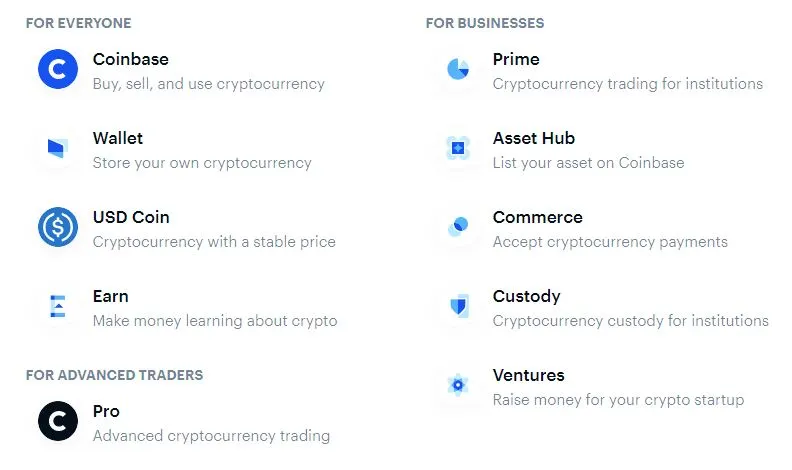

Coinbase is a cryptocurrency trading and investment platform that allows users to purchase, sell, and exchange over 100 trading cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin. The platform has more than 98 million users and more than $256 billion in assets.

For simple buy and sell orders, beginners should prefer the original Coinbase platform. More experienced users can access additional features and order types through Coinbase Pro, available to any Coinbase user. Coinbase has a mobile application for both Android and iOS.

Coinbase Features

Image Credit: coinsutra.com

- Support for many cryptocurrencies: There are numerous cryptocurrencies available, and Coinbase Wallet enables you to store a variety of digital assets, such as Bitcoin, Ethereum, and Litecoin. Additionally, it offers safe storage for Ethereum’s ERC721 digital collectibles enabling usefulness in a dynamic cryptocurrency portfolio.

- Best security practices: Coinbase Wallet takes precautions to keep your cryptocurrency collections safe. When someone connects to your account, two-factor authentication verifies their identity, and military-grade AES-256 encryption protects your data from outside threats.

- Insurance-backed: Unlike the majority of bitcoin products, the vendor’s insurance plan covers your digital assets. The service provider will pay you back for lost money if a security lapse on the platform compromises your valuables.

- Decentralized apps: The vendor gives you access to many decentralized cryptocurrency apps, exchanges, employment, and more so that you can always conduct crypto-related business in safe and secure settings.

Coinbase Pros

- Easy to use for beginners: The main Coinbase website and mobile app are relatively simple to use and let you buy, sell, and swap cryptocurrencies rapidly. This makes them ideal for cryptocurrency newcomers.

- Support for a vast number of cryptocurrencies: Over 100 cryptocurrencies are currently supported for trading on Coinbase, and the number keeps increasing.

- Possibilities for earning cryptocurrencies: Through Coinbase Earn, you can get a small amount of a new currency or earn interest on eligible holdings.

- Low pricing: Any user can move to Coinbase Pro, an active trading platform with greater features and lower costs, for a lower price.

Coinbase Cons

- High transaction costs: On the main Coinbase platform, transaction costs are frequently high.

- Issues with customer service: Coinbase receives low marks for customer support, especially in the case of major account security problems.

- Low altcoin: While Coinbase offers an impressive range of currencies, many altcoins are unavailable for trading.

Coinbase Pricing

Coinbase isn’t transparent about pricing and fees, and it recently removed its full fee schedule from the Coinbase online help section. However, costs are listed on the trade screen when entering a trade to let you know exactly what you’re paying before entering.

|

Trade Price |

Coinbase Charge |

|

< $10 |

$0.99 |

|

$10 – $25 |

$1.49 |

|

$25 – $50 |

$1.99 |

|

$50 – $200 |

$2.99 |

|

> $200 |

Percentage based fee |

Certain account funding and withdrawal methods, as well as other less typical services, may be subject to additional fees:

Note that these fees are not official, they were only confirmed through a test trade.

|

Payment Method |

Coinbase Charge |

|

Bank |

1.49% |

|

USD Wallet |

1.49% |

|

Bank Cards |

3.99% |

|

ACH Transfer |

Free of charge |

|

Wire Transfer |

$10 for incoming $25 for outgoing |

|

Crypto Conversion |

2% |

Robinhood

Image Credit: bitdegree.org

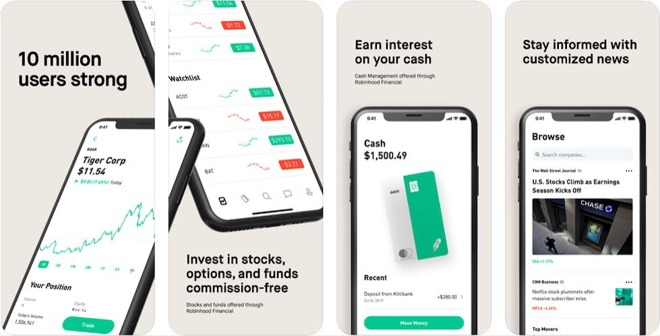

Robinhood is designed to appeal to younger investors who want to get a piece of the action, even if it means acquiring fractional shares in small amounts. The app and website are straightforward and easy to navigate thanks to more than 13 million active users, the average age of which is 31.

Robinhood can help you with cryptocurrency investing. You can use their platform to trade Bitcoin, Ethereum, and more. This crypto app has also extended its options trading platform, making it a potential option-trading broker, despite concerns about the quality of trade executions. Robinhood also has a mobile application for both Android and iOS.

Robinhood Features

Because it only provides trading in stocks, ETFs, options, and cryptocurrencies, Robinhood’s features are incredibly constrained. You cannot trade commodities, foreign exchange, or futures on Robinhood, nor do they support mutual funds or fixed income products. If you use Robinhood as your broker, you can invest in

- Solely long stocks. No selling short.

- Fractional share orders are available for stocks with a market capitalization above $25,000,000 and a share price over $1. The broker provides ETFs as well as equities.

- Optional single and multiple legs

- Bitcoin (BTC), Bitcoin Cash (BCH), Bitcoin SV (BSV), Dogecoin (DOGE), Ethereum (ETH), Ethereum Classic (ETC), and Litecoin (LTC) are all examples of cryptocurrencies you can invest in.

Robinhood Pros

- It is easy to use: Robinhood’s mobile app is extremely easy to use, although the broker offers a web-based platform, it has a mobile app. This is Robinhood’s key differentiation factor compared to its rivals. The mobile app is not robust. Although its functions are quite basic, the platform is enough for those who know exactly what they want to quickly travel from screen to screen and perform trades.

- Low trading cost: Stocks, ETFs, Options Contracts, and Cryptocurrencies can be traded for free on Robinhood, which allows users to buy fractional shares for just $1. Robinhood will reinvest all dividends from stocks or ETFs earned if you activate the dividend reinvestment program (DRIP) in your account — provided the positions support fractional share trading.

Robinhood Cons

- Limited research resources: Customers who use Robinhood have limited access to research and instructional materials. You’ll probably need to sign up for Robinhood Gold if you want more than the basic stock quotes. Even still, Robinhood’s resources are lacking in comparison to those of its rivals.

- Limited investment: You won’t be able to trade any commodities, foreign exchange, or futures on Robinhood, nor will it provide any mutual funds or fixed-income investment products. Additionally, only taxable brokerage accounts are supported by Robinhood.

- No transparency for payment: Brokers typically report order flow information for payment. Investors may compare and guarantee accurate and fast trade executions using this method the best. Robinhood is penalized for not being transparent by withholding this crucial information from the public.

Robinhood Pricing

Like the majority of its rivals, Robinhood doesn’t impose trading commissions. The following list includes some additional costs that have nothing to do with trading.

- There are no commissions on any equity trades (stocks or ETFs).

- No charges for trading options

- A $5 monthly Robinhood Gold membership, which comes with $1,000 in the margin, is required to trade on margin. The relatively low interest rate of 3.5 percent is applied to margin utilization beyond $1,000. 4

- A $75 account transfer is required.

- Both domestic and international wire costs are waived.

- There are no fees associated with opening, maintaining, or inactive accounts.

- Sending a domestic check overnight costs $20.

Coinbase Vs Robinhood

Features

As seen above, Coinbase beats Robinhood in the features department. Coinbase has a whole lot of features and Robinhood is limited.

Pros

- Both Coinbase and Robinhood are easy to use.

- Coinbase supports more currencies than Robinhood.

- Robinhood has low trading costs than Coinbase

I will go for a 50-50 here, both Coinbase and Robinhood have good pros.

Cons

- Coinbase has a high transaction cost and Robinhood does not.

- Robinhood has limited investment and Coinbase has a wide range of it.

- Coinbase has a slight issue with their customer services while Robinhood’s is above average.

Coinbase has slightly more cons than Robinhood here, so the latter stands out.

Pricing

Both Coinbase and Robinhood are free to download and use, there is no premium account.

Brokerage Charges

Coinbase and Robinhood have different fees, and it doesn’t help matters that Coinbase deliberately conceals a lot of its fees from potential clients (though they are disclosed before you place a trade). However, Robinhood’s compensation isn’t exactly straightforward.

Robinhood’s fee structure is simple compared to Coinbase. In line with the broker’s “no commissions” model for stocks and options, you won’t be required to pay any out-of-pocket costs for buying and selling cryptocurrency. Instead, the cost of trading is rolled into a spread markup on the trade, so you’ll pay more when you buy and less when you sell if you received the best market price at the time of your trade.

To put it mildly, Coinbase’s fee structure is unclear. In addition to charging different fees depending on how much you spend, it has a pro tier and a basic service tier, both with different costs. Additionally, Coinbase recently started to obfuscate the costs associated with its basic service, making it challenging for potential consumers to understand what they will be paying.

Bottom Line

Your demands will ultimately determine which firm is better for you, but it’s safe to say that individuals who are significantly invested in bitcoin or numerous different forms of cryptocurrency will find Coinbase to be a better fit. Robinhood, on the other hand, may be preferred for consumers interested in a few well-known cryptocurrencies as part of a larger portfolio. I would personally go with Coinbase here.

FAQs

Q. What Are Robinhood and Coinbase?

Ans. Coinbase and Robinhood are both cryptocurrency exchanges, with Robinhood acting as a custodian in which you can buy and sell cryptocurrencies. Robinhood added wallet functionality last year, while Coinbase is a true exchange, which allows you to trade cryptocurrency for another cryptocurrency and withdraw your coins into a digital wallet.

Q. Coinbase Vs Robinhood: Which wallet should I use?

Ans. The Coinbase Wallet is a popular crypto exchange platform that can be used on many decentralized applications. If you want to trade cryptocurrency or simply store the keys to ones you already own, the Coinbase Wallet is a safe way to store them. ERC-20 compatible, it can be traded on your favorite decentralized exchange. Robinhood has added a wallet only recently.

Q. Who should use Robinhood or Coinbase?

Ans. Coinbase and Robinhood are very easy to use for novice investors and people who want to invest small amounts. Both platforms are excellent for beginners. Crowdfunding websites such as Coinbase can be expensive, but Robinhood has no commissions, so users may pay less for a trade.

People who don’t want to withdraw crypto and prefer a single platform to trade crypto, ETFs, stocks, and options use Robinhood, because crypto can only be traded on Coinbase. For those who want to remove their coins or have more cryptocurrency choices, Coinbase’s 51 coins and digital wallet are a better option.

Q. Coinbase Vs Robinhood: Which is more secure?

Ans. Coinbase is all crypto at any time when it comes to the types of securities they offer. If you’re after anything else, such as stocks, ETFs, or options, you’ll have to look elsewhere. Robinhood, on the other hand, offers a broader range of securities, including stocks, options, ETFs, and cryptocurrencies, but it does not offer bonds or mutual funds. With a shallower crypto pool, though, the app will still lure plenty of traders.

Q. Coinbase Vs Robinhood: Which is more user-friendly?

Ans. Though Coinbase and Robinhood differ in many ways, they’re both incredibly easy to use and designed for first-time investors. On Coinbase, transactions are slightly faster because it accepts debit or credit card payments, while Robinhood only accepts ACH transactions. Both applications offer mobile apps for Android and iOS devices, with the Coinbase app receiving higher ratings.

Both sites feature a knowledge base and articles about trading. However, Coinbase takes it a step further, offering videos and the opportunity to earn cryptocurrency for watching short video clips. Both companies offer email customer support, but responses aren’t always immediate, so you may not get an immediate answer to your question regardless of which platform you use.